Everything you need to succeed

Automatic trend tracking, 450+ trading constructs, fundamental data, technical indicators, and revealing graphics and reports give you all the power and information you need. Now you can generate and test trading ideas to systematically build high performance automated investment systems tailored to your exact requirements. No programming skills are required!

Automate your investments easily

RuleTrader makes it incredibly easy to create fully automated investment systems that can be tested and then deployed for live trading, where they will save you a great deal of time, effort and stress. RuleTrader plugs into, and is fully integrated with, the UK’s #1 investment data and analysis software, Legacy ShareScope Pro or Plus, so you can seamlessly migrate your existing positions and have RuleTrader manage them for you.

Now you can harness the full power of computer automation, tailored to your exact investment style, without needing any special skills other than the ability to speak English. You can back-test your investment system, review the results, and methodically improve its performance, to produce excellent returns – we call it Evidence Based Investing (EBI). To illustrate what’s possible, we’ve included an Example Investment System that delivered over 17% p.a., on average, when back-tested over the last 10 years*.

You can also use RuleTrader to test investment ideas (e.g. does this or that guru’s advice deliver the goods?), or to analyse market traits (e.g. what company results / factors matter most?), or to test technical indicators, or to build sophisticated filters that automatically screen for new market opportunities.

* Please note that the Example System was designed to be a demonstrator of RuleTrader’s features, not a model investment system, so any use you make of it is entirely at your own risk. You should always back-test it for yourself, to get an idea of what those risks might be.

Systematically boost profits

RuleTrader lets you back-test investment ideas easily and accurately, so you can refine your system, systematically increase your returns, and become a more confident investor. Don’t hope, pray or rely on the advice of some ‘investment guru’. Test ideas to your own satisfaction, so you can find out what works, while learning a lot in the process. Then apply the successful ideas, automatically, so they’re never forgotten and you never miss an opportunity.

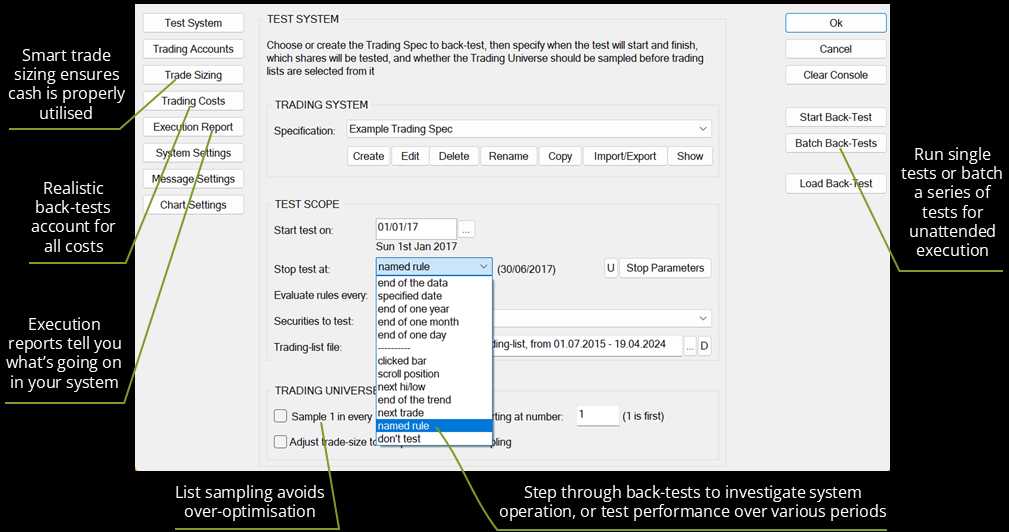

A simple dashboard lets you run tests between dates, advance the test until a condition is met, or step through it so you can troubleshoot issues. You can test one share or index, all shares selected by your trading specification, or a saved list of shares from a previous test. Multiple tests can be batched to run overnight, while automatically refining parameter values.

All dividends, trading costs, spreads and taxes are automatically included, so you get a conservative, believable view of returns over the test period. And RuleTrader is designed to help you avoid mistakes, such as over-optimisation, by facilitating tests against different cohorts of shares, or over different time periods. It even warns you if choices you’ve made may introduce an inadvertent bias in your results.

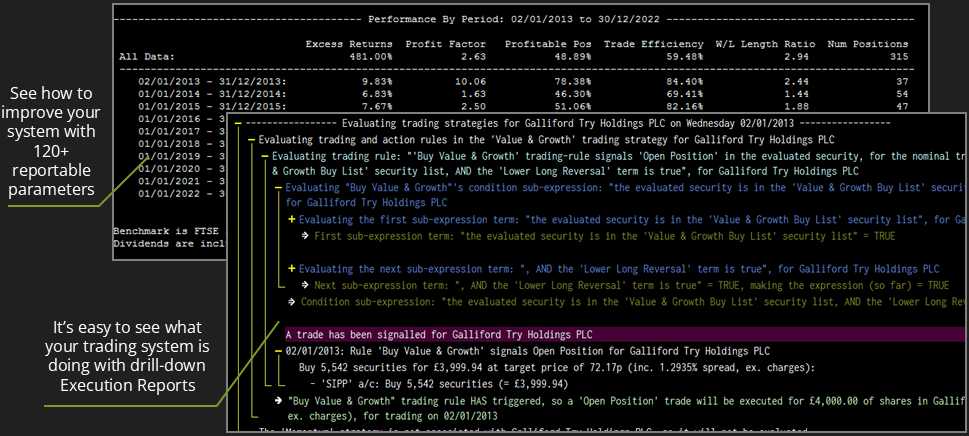

Discover how to improve returns and reduce risk

RuleTrader’s transparency means you can see what’s going on in your investment system, at all times, so you can be confident it’s doing what’s expected. And 120+ reportable parameters and automatic chart graphics tell you all you need to know about your investment system’s performance, including ratios, profits, periods, counts, values, run-ups and draw-downs. Drill down to see what works, where the risks are, and how to improve your returns. And because RuleTrader accounts for all trading costs, taxes, and estimated spreads, you’re assured of conservative numbers that you can believe in.

This combination of investment automation, conservative back-tests, and detailed reports engenders a virtuous circle of test → evaluate → enhance that lets you systematically improve your returns, while building increasing confidence in your investment system, without putting any money at risk. It’s rewarding, educational and, surprisingly, fun!

Save time, effort & stress

Once you’re happy with your system, transfer it to RuleTrader Live and let it find new opportunities and manage your investments, automatically. You’re always in control because a dashboard lets you fine-tune your system, without recompiling it, and custom columns and chart graphics let you keep a close eye on key values in your specification, at all times. Meanwhile, the Definition Engine growls away, re-evaluating your trading rules against every new item of data and doing all the hard work for you, saving you a huge amount of time and effort.

Because it takes just seconds to check for signals, it’s now practical to review opportunities daily, so you can get in or out quickly before prices move too far. If a signal has been raised, RuleTrader will tell you the quantity, target price and trading account to use (it supports multiple accounts and currencies). Then execute the trade with your broker and enter the price you obtained in RuleTrader. Job done!

RuleTrader makes life so much less stressful. Gone is the angst, equivocation, and dithering. Gone are the stress and corrosive emotions that spawn bad decisions. RuleTrader sweats the details for you, applying your proven rules dispassionately, consistently and effectively.

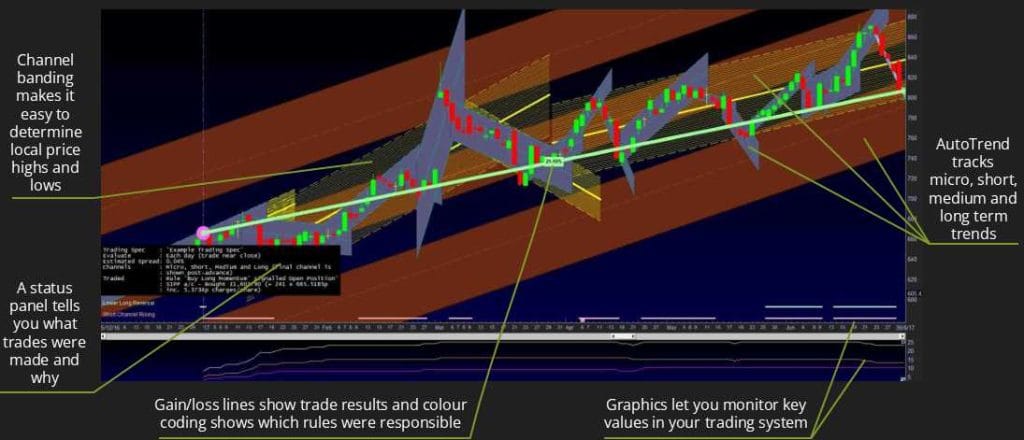

Exploit trends automatically

Getting on a trend early can yield huge profits. RuleTrader’s proprietary AutoTrendTM system lets you easily find and exploit micro, short, medium and long term trends that occur over days, weeks, months or years. So no more wading through charts because AutoTrendTM does it for you. It automatically detects when trends have started and finished, draws price-channels and trend-lines, and provides trend growth rates, lengths, price swings, standard deviations and other statistics.

Trend channels are automatically divided into bands, making it very easy to determine local price highs and lows relative to the trend line. You can use this to help predict tops and bottoms: analysis shows that greater than 2/3 of price turns occur at or beyond 1.6 standard deviations from the long channel trend-line and over 1/2 occur at or beyond 1.9 standard deviations. Odds like that make it possible to automatically discover the prices to enter and exit positions. Similarly, RuleTrader detecting a trend has broken, can be a great signal to automatically stop potential losses.

As well as AutoTrendTM, there’s a wide range of statistical calculations and technical indicators, including MACDs, Bollinger bands, moving averages, price highs/lows, standard deviations, correlations, stochastic oscillators, RSI, ADI, etc., or you can create your own. Combined with ShareScope’s superb database of company results and share prices, this gives you everything you need to automatically screen for winners and determine the optimum time to invest, using whatever fundamental and/or technical data you want, to deliver the profits you want.

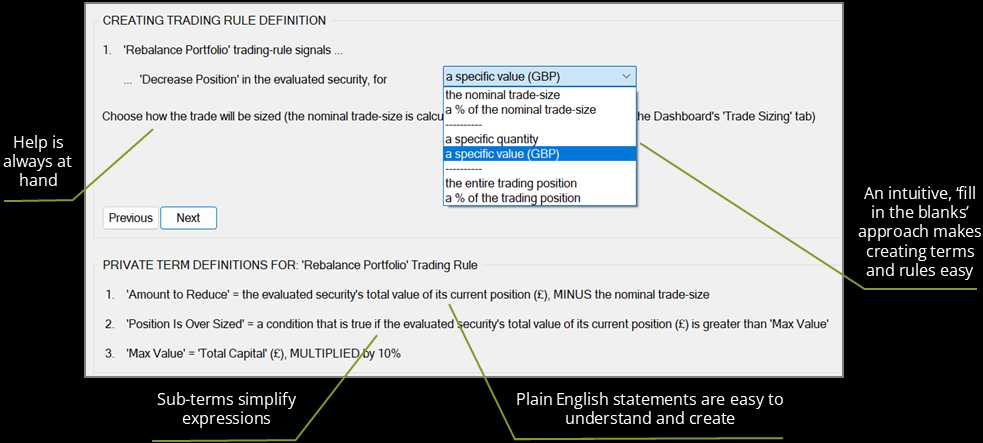

Power without programming

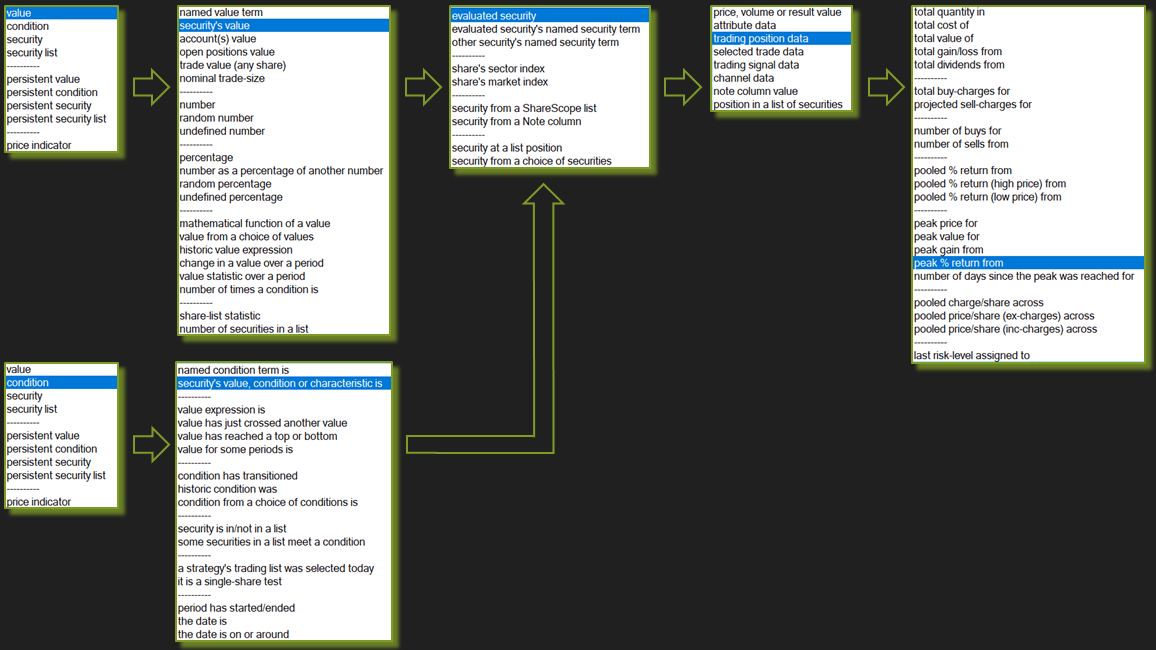

RuleTrader layers ease of use over extraordinary power, literally. The middle layer contains our unique invention, the Definition Engine for Trading (DEfTTM). On the top layer, DEfTTM leads you intuitively through the construction of an English language trading specification that tells RuleTrader when to make a trade (in back-tests), or when to raise a trading signal (in the live system). It does this by dynamically presenting choices, relevant to the current context, using a ‘fill in the blanks’ / ‘pick an option’ dialog. Then on the bottom layer, DEfTTM converts your specification to computer code.

So there are no programming languages or tedious technicalities to learn but you still get all the power and flexibility of code running at full speed on your PC. Your system may be as simple as a single trading idea for testing against an index. Or it can contain multiple strategies, each activated according to market conditions. These strategies select their own trading lists and decide when shares in those lists should be traded.

Create without limits

Over 450 constructs produce endless possibilities, so the size and sophistication of your investment system is virtually unlimited. With RuleTrader you can compute and test technical indicators, signals, trading position values, historic trade data, price channels, share prices, trading volumes and company results (present, past and forecast), along with their growth rates, rankings, trends, averages, correlations and many other statistics. It also provides the computational power and statistical expressions necessary for you to design your own technical indicators, filters, scoring systems and decision making criteria.

Share lists can be compiled automatically for statistics, rankings and scores, or to find opportunities, or black-list potential disasters. Relate shares for pairs trading, or indices for sector benchmarks. Count events, or test for price crosses, tops and bottoms, or periodic or calendar conditions. The only thing it doesn’t do is call your broker, so you always have the final say.