Provable performance

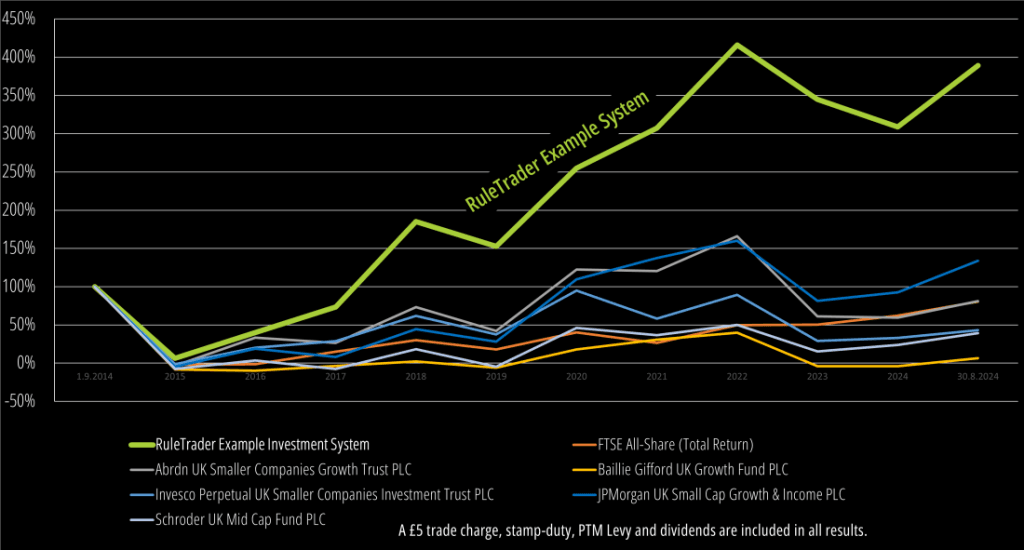

To demonstrate RuleTrader’s effectiveness we’ve included a free Example Investment System that returns 17% p.a. in back-tests over the last 10 years. That’s 300% more than the FTSE All-Share (Total Return) index.

But don’t take our word for it. The great thing about RuleTrader is that you can test investment ideas, including our claims, before you risk your hard-earned money. We call it Evidence Based Investing (EBI)

An alternative to under-performing funds and index trackers

Developed in the first half of 2022, the Example Investment System continues to perform well today. When back-tested over the last 10 years it produced excess returns of between 255% – 383%, relative to its benchmark UK small/mid-cap funds and the FTSE All-Share (Total Return) index. It did this while taking full account of costs and trading only LSE shares, without using risky shorts or leverage and, as we describe in our article “Anatomy of a High Performance Investment System”, it uses only 8, common-sense investment rules. So it really isn’t complicated!

The Example System is included with RuleTrader and while you may wish to use it as a starting point for your own trading system, you should bear in mind that it was developed primarily as a demonstration of RuleTrader’s features, not as a model investment approach, so any use you make of the system must be entirely at your own risk.

Secrets of the Example System’s Success

It’s powerful – The Example system contains two strategies. The Value & Growth strategy picks excellent companies using a five-factor score, which is designed to pick the diamonds from the dogs. Applying such a sophisticated filter manually would be very arduous but with RuleTrader it’s automatic. Similarly, the Momentum strategy uses RuleTrader’s unique AutoTrendTM function to jump on trends at a local low and to exit at a high, or when the trend breaks.

It cuts its losses early and lets its profits run – You’ll see in the figures below that the profits it makes are over twice as large as its losses. Part of the reason for this is that, on average, it holds winning positions for over two and a half times longer (> 10 months) than losing positions (4 months).

It combines fundamentals with technical analysis – The Value & Growth strategy selects potential opportunities based on fundamentals, then uses RuleTrader’s powerful technical analysis capabilities, such as its unique AutoTrendTM price-channels, to determine the optimum time to enter and exit positions. This ability to combine fundamental and technical approaches is one of RuleTrader’s great strengths.

It acts quickly – The back-test assumes orders are placed at close on the day a signal is raised (you can also simulate trading the next day, based on information from the evening before, if that’s a better fit with your investment style). To replicate these results in a live system, you’d need to review your trading signals daily. As that takes just seconds with RuleTrader, it’s super easy to do, which means you can now exploit your key advantage over the big institutions – your speed – with zero effort.

It’s dispassionate – How often have emotions clouded your judgement? Perhaps recent wins made you reckless, or losses made you too cautious? RuleTrader doesn’t do angst – it just consistently applies the rules you devise. The key is to use its tools to build a mechanical system that doesn’t care about wins and losses, only profit ratios. Tailor it to your needs, back-test it to build your confidence then, when you’re satisfied with its performance, activate it in RuleTrader Live and let your computer put in all the effort. Then kick back, relax and say goodbye to stress, heart-ache and hard work!

Example System test results 1.9.2014 – 30.8.2024

The results from back-testing the Example System, against sterling denominated LSE shares over the last 10 years, were generated using RuleTrader’s powerful reporting module and are displayed in the tabbed tables below. Trades were entered at the day’s close price for a nominal trade-size of 4% of capital, targeting 25 positions. Excess returns are versus its benchmark: the FTSE All-Share (Total Return) index. Results include a £5 charge per trade and take account of spreads, taxes and dividends. Shorts and leverage are NOT used.

| SIPP | |

| CAGR: | 17.21% |

| Capital Growth: | 389.08% |

| Excess Return vs Bnchmk: | 308.21% |

| Benchmark Returns: | 80.87% |

| Avg Monthly Return: | 1.43% |

| Monthly Volatility: | 4.57% |

| Profit Factor (gains/losses): | 2.02 |

| Drag: | 4.77% |

| Dividend Yield: | 1.72% |

| Dividend/Trading Profit: | 19.07% |

| Profitable Positions %: | 46.32% |

| Trade Efficiency (wins): | 61.09% |

| Profitable Shares %: | 50.47% |

| Max Pos Loss (% of capital): | 2.94% |

| Capital At Start: | £40,000.00 |

| Capital At End: | £195,631.25 |

| Dividends: | £29,679.42 |

| Total Profit: | £155,632.58 |

| Total Annualised Profit: | £15,566.09 |

| Avg Pos Length (wins): | 235.64 days |

| Avg Pos Length (losses): | 89.40 days |

| Win/Lose Length Ratio: | 2.64 |

| Number Of Positions: | 367 |

| Num Winning Positions: | 170 |

| Num Losing Positions: | 197 |

| Num Open Positions: | 25 |

| Num Open Positions (winning): | 21 |

| Number Of Shares Traded: | 214 |

| Cap. Growth | Excess Returns | Profit Factor | Sharpe (r/free) | Profitable Pos | Trade Efficiency | Num Positions | |

|---|---|---|---|---|---|---|---|

| All Data: | 389.08% | 308.21% | 2.02 | 0.31 | 46.32% | 61.09% | 367 |

| 01/09/2014 – 31/12/2014: | 6.32% | 8.53% | 3.97 | 0.79 | 73.08% | 72.14% | 26 |

| 01/01/2015 – 31/12/2015: | 31.82% | 30.84% | 7.44 | 1 | 70.27% | 82.13% | 37 |

| 01/01/2016 – 31/12/2016: | 23.68% | 6.92% | 2.49 | 0.49 | 48.15% | 73.35% | 54 |

| 01/01/2017 – 31/12/2017: | 64.53% | 51.44% | 11.88 | 1.16 | 71.43% | 74.04% | 49 |

| 01/01/2018 – 31/12/2018: | -11.39% | -1.91% | 0.46 | -0.22 | 30.51% | 42.91% | 59 |

| 01/01/2019 – 31/12/2019: | 40.42% | 21.26% | 5.68 | 0.85 | 72.34% | 70.57% | 47 |

| 01/01/2020 – 31/12/2020: | 14.76% | 24.58% | 1.43 | 0.17 | 44.44% | 77.26% | 72 |

| 01/01/2021 – 31/12/2021: | 26.72% | 8.39% | 3.43 | 0.48 | 53.03% | 56.13% | 66 |

| 01/01/2022 – 31/12/2022: | -13.78% | -14.12% | 0.39 | -0.48 | 26.15% | 56.11% | 65 |

| 01/01/2023 – 31/12/2023: | -8.09% | -16.00% | 0.66 | -0.19 | 37.50% | 57.18% | 72 |

| 01/01/2024 – 30/08/2024: | 19.58% | 8.30% | 3.9 | 0.71 | 59.09% | 64.51% | 44 |

| ROI | Profit Factor | Profitable Pos | Trade Efficiency | Num Positions | |

|---|---|---|---|---|---|

| Buy Long Momentum: | 9.06% | 2.11 | 50.54% | 58.81% | 186 |

| Buy Value & Growth: | 8.94% | 1.94 | 41.99% | 63.61% | 181 |

| Rebalance Portfolio: | 279.91% | Infinity | 100.00% | 98.74% | 5 |

| Sell Momentum High: | 15.84% | 5.22 | 64.06% | 54.87% | 64 |

| Sell Momentum Now: | 14.49% | 4.68 | 57.14% | 67.51% | 21 |

| Sell Value & Growth If Underperforms: | 24.79% | 6.76 | 65.00% | 67.69% | 20 |

| Sell Value & Growth On Long Fall: | 1.98% | 1.17 | 34.69% | 56.76% | 147 |

| Stop Momentum Loss: | -6.13% | 0.56 | 31.76% | 43.76% | 85 |

| ROI | Dividend Yield | Average Spread | Trading Profit | |

|---|---|---|---|---|

| Nexxen International Ltd: | 95.14% | 0.29% | 0.40% | £15,464.99 |

| SDI Group PLC: | 55.91% | 0.00% | 1.72% | £12,639.72 |

| Games Workshop Group PLC: | 108.51% | 8.05% | 0.19% | £11,098.40 |

| CMC Markets PLC: | 97.85% | 7.30% | 0.40% | £9,331.00 |

| AB Dynamics PLC: | 436.32% | 2.54% | 1.55% | £7,756.58 |

| Keywords Studios PLC: | 118.88% | 0.28% | 0.24% | £7,285.37 |

| BAE Systems PLC: | 94.67% | 9.79% | 0.04% | £6,909.91 |

| Yu Group PLC: | 54.43% | 2.94% | 3.51% | £6,790.16 |

| Victoria PLC: | 141.34% | 0.00% | 0.76% | £6,663.92 |

| Warpaint London PLC: | 103.52% | 4.91% | 3.33% | £6,605.23 |

| Rolls-Royce Group PLC: | 33.04% | 0.00% | 0.05% | £6,370.53 |

| Evoke PLC: | 143.93% | 14.51% | 0.24% | £5,872.55 |

| IQE PLC: | 124.78% | 0.00% | 0.66% | £5,725.76 |

| Fevertree Drinks PLC: | 99.98% | 0.96% | 0.22% | £5,652.16 |

| Pan African Resources PLC: | 89.17% | 2.11% | 0.41% | £5,253.03 |

| Future PLC: | 19.13% | 0.05% | 0.16% | £5,051.27 |

| Trustpilot Group PLC: | 103.49% | 0.00% | 0.46% | £5,051.08 |

| Sylvania Platinum Ltd : | 18.66% | 2.99% | 2.57% | £4,912.95 |

| Seeing Machines Ltd: | 36.79% | 0.00% | 1.40% | £4,893.05 |

| Volex Group PLC: | 31.68% | 1.06% | 0.51% | £4,887.52 |

| Reach PLC: | 44.08% | 3.07% | 0.43% | £4,504.91 |

| JD Sports Fashion PLC: | 81.92% | 1.25% | 0.11% | £4,383.23 |

| International Distributions Services PLC: | 75.53% | 4.12% | 0.09% | £4,202.31 |

| Costain Group PLC: | 36.83% | 0.69% | 3.83% | £3,914.01 |

| Premier Foods PLC: | 94.49% | 0.00% | 0.32% | £3,860.68 |

| Me Group International PLC: | 20.32% | 4.69% | 0.77% | £3,672.73 |

| Burford Capital Ltd: | 31.83% | 1.29% | 0.25% | £3,273.62 |

| Ceres Power Holdings PLC: | 37.81% | 0.00% | 0.39% | £3,125.94 |

| Galliford Try Holdings PLC: | 21.93% | 8.25% | 1.55% | £3,089.03 |

| Treatt PLC: | 19.53% | 0.56% | 0.60% | £2,950.81 |

| Aptitude Software Group PLC: | 124.56% | 3.60% | 2.30% | £2,946.49 |

| Renold PLC: | 41.82% | 1.26% | 3.39% | £2,841.71 |

| Jarvis Securities PLC: | 27.85% | 6.00% | 0.81% | £2,762.54 |

| Bloomsbury Publishing PLC: | 19.19% | 5.51% | 1.89% | £2,756.46 |

| London Stock Exchange Group PLC: | 50.91% | 1.47% | 0.06% | £2,702.09 |

| S4 Capital PLC: | 44.40% | 0.00% | 0.29% | £2,564.54 |

| Boohoo Group PLC: | 43.45% | 0.00% | 0.27% | £2,537.18 |

| System1 Group PLC: | 122.11% | 3.58% | 1.59% | £2,512.92 |

| Avon Technologies PLC: | 73.37% | 1.31% | 0.66% | £2,472.26 |

| Babcock International Group PLC: | 38.19% | 1.31% | 0.17% | £2,344.76 |

| Advanced Medical Solutions Group PLC: | 143.42% | 3.15% | 0.85% | £2,248.04 |

| Persimmon PLC: | 27.94% | 3.04% | 0.07% | £1,912.09 |

| Aviva PLC: | 21.45% | 19.48% | 0.05% | £1,905.62 |

| Team Internet Group: | 25.36% | 0.00% | 0.90% | £1,797.29 |

| Hargreaves Services PLC: | 13.21% | 3.89% | 3.47% | £1,766.89 |

| Luceco PLC: | 27.50% | 4.04% | 1.32% | £1,739.98 |

| Trifast PLC: | 103.77% | 7.74% | 2.76% | £1,703.10 |

| Litigation Capital Management Ltd: | 11.78% | 1.28% | 2.44% | £1,646.27 |

| Kainos Group Ltd: | 16.91% | 3.92% | 0.28% | £1,639.70 |

| RWS Holdings PLC: | 87.76% | 7.62% | 0.26% | £1,554.64 |

| Somero Enterprises Inc: | 4.62% | 4.67% | 2.05% | £1,547.31 |

| Marshalls PLC: | 24.41% | 2.74% | 0.20% | £1,539.39 |

| Johnson Service Group PLC: | 31.87% | 1.48% | 0.95% | £1,498.73 |

| Mortgage Advice Bureau Holdings Ltd: | 61.92% | 12.37% | 3.89% | £1,323.16 |

| ASOS PLC: | 32.72% | 0.00% | 0.23% | £1,321.60 |

| Greggs PLC: | 34.31% | 1.66% | 0.13% | £1,291.64 |

| 4imprint Group PLC: | 14.45% | 6.14% | 0.60% | £1,199.45 |

| Mitie Group PLC: | 12.23% | 0.00% | 0.28% | £1,197.92 |

| Thorpe (F W) PLC: | 53.95% | 3.34% | 2.00% | £1,169.40 |

| Plus500 Ltd: | 6.97% | 5.40% | 0.12% | £1,159.29 |

| Property Franchise Group (The) PLC: | 8.68% | 2.39% | 2.13% | £1,103.40 |

| Nexteq PLC: | 21.55% | 0.92% | 1.25% | £1,070.94 |

| Beazley PLC: | 14.62% | 2.86% | 0.12% | £1,031.50 |

| Spirent Communications PLC: | 24.52% | 4.27% | 0.21% | £924.88 |

| Coats Group PLC: | 42.27% | 2.32% | 0.36% | £848.73 |

| Melrose Industries PLC: | 50.01% | 2.37% | 0.07% | £821.50 |

| Science Group PLC: | 19.41% | 0.00% | 2.23% | £788.80 |

| Cohort PLC: | 23.03% | 0.00% | 3.98% | £765.87 |

| Oxford Metrics PLC: | 15.38% | 2.14% | 2.11% | £736.95 |

| Latham (James) PLC: | 5.62% | 4.56% | 1.68% | £681.03 |

| Balfour Beatty PLC: | 10.27% | 3.38% | 0.14% | £667.17 |

| Midwich Group PLC: | 14.37% | 2.89% | 2.08% | £634.68 |

| Team17 Group PLC: | 15.71% | 0.00% | 2.50% | £629.66 |

| British American Tobacco PLC: | 8.35% | 7.06% | 0.03% | £610.90 |

| Character Group (The) PLC: | 4.93% | 3.41% | 1.31% | £609.36 |

| Redcentric PLC: | 36.31% | 4.00% | 1.52% | £578.29 |

| Hochschild Mining PLC: | 3.33% | 0.00% | 0.27% | £551.55 |

| Workspace Group PLC: | 33.28% | 2.62% | 0.25% | £535.25 |

| Macfarlane Group PLC: | 10.55% | 2.56% | 2.07% | £468.00 |

| SigmaRoc PLC: | 9.76% | 0.00% | 2.00% | £459.40 |

| Jubilee Metals Group PLC: | 9.89% | 0.00% | 1.73% | £452.07 |

| Telecom plus PLC: | 11.45% | 1.87% | 0.23% | £450.51 |

| Bellway PLC: | 27.04% | 4.16% | 0.15% | £425.98 |

| Solid State PLC: | 4.45% | 0.90% | 2.43% | £413.52 |

| WH Smith PLC: | 20.99% | 4.95% | 0.13% | £345.24 |

| IG Design Group PLC: | 7.70% | 0.45% | 2.96% | £330.56 |

| Smiths News PLC: | 3.17% | 4.15% | 1.52% | £326.92 |

| Deliveroo Holdings PLC: | 4.93% | 0.00% | 1.01% | £316.87 |

| Direct Line Insurance Group PLC: | 19.15% | 13.94% | 0.09% | £308.08 |

| M&C Saatchi PLC: | 4.55% | 0.59% | 1.93% | £277.72 |

| Centrica PLC: | 3.51% | 0.00% | 0.07% | £256.68 |

| Carnival PLC: | 15.98% | 2.63% | 0.16% | £250.13 |

| IDOX PLC: | 5.13% | 0.47% | 1.78% | £247.81 |

| RBG Holdings PLC: | 4.22% | 0.00% | 3.14% | £233.04 |

| Experian PLC: | 8.92% | 0.72% | 0.07% | £227.20 |

| Airtel Africa PLC: | 2.31% | 1.86% | 0.16% | £214.63 |

| Frasers Group PLC: | 3.55% | 0.00% | 0.19% | £178.99 |

| Mountview Estates PLC: | 11.44% | 2.54% | 1.08% | £173.37 |

| UNITE Group PLC: | 3.57% | 1.94% | 0.17% | £156.10 |

| Alfa Financial Software Holdings PLC: | 5.26% | 11.15% | 1.08% | £150.87 |

| H&T Group PLC: | 0.52% | 3.11% | 2.96% | £75.08 |

| Celebrus Technologies PLC: | 0.61% | 1.28% | 1.04% | £62.14 |

| XP Power Ltd: | 1.46% | 1.34% | 0.59% | £61.82 |

| Renishaw PLC: | 2.53% | 0.65% | 0.19% | £41.31 |

| Fonix PLC: | 0.29% | 1.26% | 2.80% | £40.71 |

| Tribal Group PLC: | 0.54% | 0.00% | 2.05% | £40.04 |

| Serco Group PLC: | 0.58% | 0.00% | 0.10% | £21.74 |

| Renew Holdings PLC: | 0.33% | 2.00% | 2.16% | £9.48 |

| Fresnillo PLC: | 0.00% | 0.23% | 0.11% | -£0.10 |

| Alumasc Group PLC: | -0.14% | 0.00% | 1.31% | -£7.28 |

| Argentex Group PLC: | -0.22% | 0.00% | 2.89% | -£33.19 |

| PageGroup PLC: | -1.48% | 4.77% | 0.18% | -£56.52 |

| Moonpig Group PLC: | -1.15% | 0.00% | 0.32% | -£78.55 |

| Anexo Group PLC: | -1.16% | 1.49% | 2.39% | -£101.86 |

| Equals Group PLC: | -2.80% | 0.00% | 1.82% | -£103.09 |

| Bakkavor Group PLC: | -1.47% | 3.20% | 4.54% | -£109.20 |

| Chesnara PLC: | -7.28% | 0.00% | 1.12% | -£116.54 |

| Darktrace PLC: | -3.43% | 0.00% | 0.23% | -£147.76 |

| Flutter Entertainment PLC: | -9.05% | 0.00% | 0.07% | -£163.87 |

| MJ Gleeson PLC: | -9.52% | 0.76% | 2.93% | -£178.90 |

| Softcat PLC: | -6.88% | 0.00% | 0.18% | -£198.16 |

| De La Rue PLC: | -3.04% | 0.00% | 0.60% | -£199.46 |

| Goodwin PLC: | -1.01% | 2.88% | 4.47% | -£203.67 |

| STV Group PLC: | -3.25% | 1.12% | 1.64% | -£206.90 |

| Wilmington PLC: | -3.24% | 0.00% | 2.55% | -£220.21 |

| Network International Holdings PLC: | -1.79% | 0.00% | 0.51% | -£223.83 |

| Harworth Group PLC: | -2.78% | 0.00% | 1.30% | -£229.46 |

| QinetiQ Group PLC: | -3.33% | 1.43% | 0.13% | -£233.88 |

| Churchill China PLC: | -0.86% | 1.02% | 0.78% | -£248.83 |

| Naked Wines PLC: | -15.25% | 0.00% | 0.76% | -£260.30 |

| Dotdigital Group PLC: | -4.28% | 1.13% | 0.67% | -£273.91 |

| Gear4music (Holdings) PLC: | -3.85% | 0.00% | 2.12% | -£274.35 |

| Fintel PLC: | -3.81% | 0.00% | 2.07% | -£277.41 |

| Ebiquity PLC: | -7.84% | 0.00% | 2.35% | -£286.21 |

| Zytronic PLC: | -17.44% | 2.17% | 3.54% | -£310.45 |

| BATM Advanced Communications Ltd: | -5.59% | 0.00% | 1.91% | -£323.49 |

| TP ICAP PLC: | -7.55% | 1.66% | 0.24% | -£336.94 |

| Shoe Zone PLC: | -5.71% | 0.00% | 4.98% | -£364.26 |

| PayPoint PLC: | -4.85% | 2.37% | 0.36% | -£378.46 |

| Topps Tiles PLC: | -11.81% | 0.00% | 2.94% | -£379.53 |

| Tracsis PLC: | -10.01% | 0.15% | 0.63% | -£384.82 |

| Michelmersh Brick Holdings PLC: | -7.23% | 0.00% | 2.34% | -£387.32 |

| Centamin PLC: | -4.57% | 1.96% | 0.15% | -£419.66 |

| Drax Group PLC: | -19.86% | 0.00% | 0.15% | -£427.83 |

| Pinewood Technologies Group PLC: | -5.73% | 0.00% | 1.35% | -£439.95 |

| Speedy Hire PLC: | -28.13% | 1.02% | 0.47% | -£443.58 |

| Petra Diamonds Ltd: | -6.82% | 0.00% | 1.12% | -£447.05 |

| Tristel PLC: | -11.38% | 0.00% | 3.86% | -£455.77 |

| Caledonia Mining Corp: | -7.27% | 1.26% | 2.15% | -£461.46 |

| Hostelworld Group PLC: | -18.91% | 0.00% | 1.07% | -£463.67 |

| Revolution Bars Group PLC: | -10.88% | 1.54% | 1.48% | -£465.47 |

| EKF Diagnostics Holdings PLC: | -12.59% | 0.00% | 3.52% | -£481.34 |

| Cerillion PLC: | -7.96% | 0.53% | 1.37% | -£515.58 |

| Braemar PLC: | -7.59% | 4.38% | 2.12% | -£535.16 |

| Volution Group PLC: | -5.71% | 0.92% | 0.34% | -£552.08 |

| Marks Electrical Group PLC: | -9.21% | 0.66% | 0.73% | -£576.39 |

| ITM Power PLC: | -21.78% | 0.00% | 0.32% | -£621.56 |

| CVS Group PLC: | -11.75% | 0.54% | 0.26% | -£641.31 |

| Judges Scientific PLC: | -4.15% | 1.73% | 2.24% | -£648.49 |

| Learning Technologies Group PLC: | -18.00% | 0.00% | 0.39% | -£656.33 |

| Victorian Plumbing Group PLC: | -6.10% | 0.51% | 2.29% | -£657.52 |

| GB Group PLC: | -17.33% | 0.49% | 0.26% | -£660.31 |

| Concurrent Technologies PLC: | -11.76% | 0.96% | 2.48% | -£676.03 |

| Wynnstay Group PLC: | -6.32% | 3.42% | 1.70% | -£680.26 |

| FRP Advisory Group PLC: | -9.60% | 1.78% | 0.73% | -£684.53 |

| XLMedia PLC: | -4.51% | 2.46% | 3.03% | -£739.52 |

| RM PLC: | -18.50% | 0.00% | 2.10% | -£740.09 |

| Porvair PLC: | -7.72% | 0.61% | 3.70% | -£753.87 |

| Just Group PLC: | -10.26% | 0.00% | 0.33% | -£774.22 |

| Rotork PLC: | -18.61% | 0.61% | 0.18% | -£775.14 |

| Barratt Developments PLC: | -7.79% | 2.70% | 0.07% | -£833.02 |

| BT Group PLC: | -11.43% | 0.00% | 0.05% | -£833.85 |

| Domino’s Pizza Group PLC: | -15.08% | 1.81% | 0.18% | -£869.52 |

| Nanoco Group PLC: | -36.99% | 0.00% | 1.37% | -£876.75 |

| Focusrite PLC: | -20.03% | 0.22% | 2.47% | -£879.21 |

| NCC Group PLC: | -20.67% | 0.64% | 0.49% | -£906.02 |

| Portmeirion Group PLC: | -8.09% | 0.42% | 1.08% | -£942.16 |

| Auto Trader Group PLC: | -14.74% | 0.81% | 0.08% | -£1,014.24 |

| Elixirr International PLC: | -19.79% | 0.00% | 1.90% | -£1,158.01 |

| The Pebble Group PLC: | -17.31% | 1.76% | 3.19% | -£1,172.10 |

| Mobico Group PLC: | -15.57% | 0.00% | 0.22% | -£1,172.96 |

| Jet2 PLC: | -7.42% | 0.25% | 0.25% | -£1,179.42 |

| Nichols PLC: | -14.56% | 0.00% | 2.81% | -£1,194.80 |

| DFS Furniture PLC: | -20.21% | 0.00% | 0.71% | -£1,226.50 |

| Restore PLC: | -16.27% | 0.50% | 2.44% | -£1,227.61 |

| Wise PLC: | -11.27% | 0.00% | 0.25% | -£1,242.56 |

| M.P. Evans Group PLC: | -17.02% | 2.51% | 1.27% | -£1,258.29 |

| Wheaton Precious Metals Corp: | -9.95% | 0.37% | 2.97% | -£1,275.21 |

| Trainline PLC: | -18.80% | 0.00% | 0.36% | -£1,371.74 |

| Renewi PLC: | -8.16% | 0.12% | 0.28% | -£1,401.08 |

| Severfield PLC: | -8.68% | 0.58% | 2.59% | -£1,445.81 |

| Entain PLC: | -11.11% | 0.81% | 0.10% | -£1,445.82 |

| Vertu Motors PLC: | -5.68% | 1.03% | 0.77% | -£1,448.62 |

| Prudential PLC: | -22.51% | 0.00% | 0.06% | -£1,448.65 |

| Atalaya Mining PLC: | -18.95% | 0.00% | 2.25% | -£1,458.68 |

| LSL Property Services PLC: | -11.14% | 2.61% | 2.51% | -£1,490.60 |

| Peel Hunt Ltd: | -23.94% | 0.00% | 0.81% | -£1,521.64 |

| Next 15 Group PLC: | -22.48% | 0.00% | 0.51% | -£1,663.72 |

| SSP Group PLC: | -22.02% | 0.00% | 0.15% | -£1,676.68 |

| Norcros PLC: | -21.58% | 0.22% | 1.94% | -£1,771.91 |

| Woodbois Ltd: | -26.58% | 0.00% | 3.17% | -£1,894.50 |

| Accesso Technology Group PLC: | -19.52% | 0.00% | 1.45% | -£1,944.96 |

| Alpha Group International PLC: | -11.45% | 0.06% | 3.20% | -£1,945.93 |

| NWF Group PLC: | -16.00% | 0.40% | 2.24% | -£2,300.04 |

| Aston Martin Lagonda Global Holdings PLC: | -38.12% | 0.00% | 0.54% | -£2,325.36 |

| Sanderson Design Group PLC: | -20.31% | 1.15% | 2.84% | -£2,347.75 |

| Supreme PLC: | -12.71% | 1.99% | 2.91% | -£2,649.19 |

| Strix Group PLC: | -17.27% | 0.00% | 0.55% | -£2,780.82 |

| Capita PLC: | -21.79% | 0.00% | 0.63% | -£2,808.80 |

| Gateley (Holdings) PLC: | -13.62% | 1.86% | 2.02% | -£3,380.42 |

| Ramsdens Holdings PLC: | -24.34% | 1.78% | 1.16% | -£3,436.24 |

| Card Factory PLC: | -18.31% | 0.00% | 0.51% | -£3,846.22 |

| SolGold PLC: | -28.23% | 0.00% | 0.63% | -£4,865.20 |

| Calnex Solutions PLC: | -34.35% | 0.32% | 1.96% | -£6,143.33 |