The Example Investment System

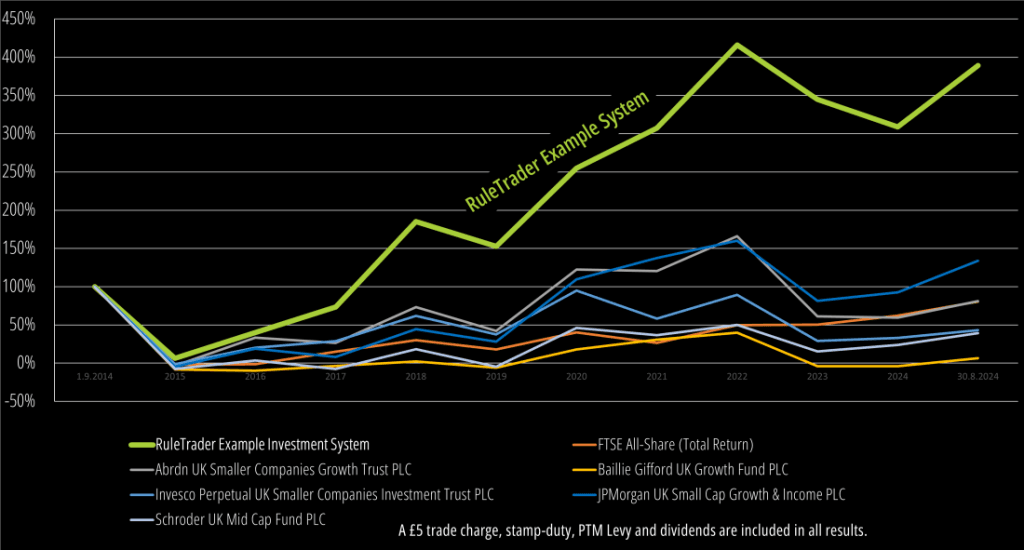

Developed in the first half of 2022, the Example Investment System (included free with RuleTrader™) continues to perform well today. When back-tested over the 10 years to the end of August 2024, it returned 17%+ p.a. and produced excess returns of over 300% relative to the FTSE All-Share (Total Return) index. It did this using only 8, common-sense trading rules, while taking full account of trading costs and without using risky shorts or leverage.

This document explains how this was achieved, while also making the point that it is the advantages inherent in the investment process enabled by RuleTrader™, as much as the trading rules themselves, that are responsible for the system’s superior performance.

Please note that the Example System was developed as a demonstrator of RuleTrader’s™ capabilities, NOT as a model investment system, so any use you make of it must be entirely at your own risk. Furthermore, this article is not intended to provide and should not be construed as providing investment or financial advice and should not be relied on for making investment decisions. Nor is it intended as an endorsement or recommendation to use the strategies described herein. Please ensure you read our Disclaimer – it is for your protection

Overview

The system first selects a trading universe of all ordinary shares on the London Stock Exchange (LSE) that are denominated in sterling. It excludes:

- a small number of shares with no market sector specified

- Closed, Open and Miscellaneous investment vehicles, Asset Managers and all Investment Trusts

- Banks, whose financial reporting methodology requires specialist expertise

- Aluminium, Copper, Iron, Steel, Nonferrous metals, General Mining, Oil, Gas and Coal commodities, as these are best handled with a specialist strategy

From this universe, trading lists are selected each month for each of the two strategies defined in the Example Investment System: the Value & Growth Strategy, and the Momentum Strategy.

Value & Growth Strategy

This strategy targets smallish companies using a 5-factor scoring system that is designed to pick those companies that most effectively generate turnover and convert it to cash. It also includes measures designed to pick companies that have attracted market interest but which are still affordable given the returns they promise.

Creating the strategy’s trading list

The V&G strategy’s trading list is composed of companies with a market cap of £25M – £250M that are liquid, with a spread less than 3% and which have:

- Good Liquidity: by requiring an average trading volume for each share that is 10x the volume of the share that may be purchased for any one position, we are reassured that there is likely to be a market for the position when we come to sell.

- Reasonable Return: this requires each company to have a Return on Capital Employed (ROCE) and/or a Cash Return on Capital Invested (CROCI) that is 10% or more, either for the last year the result is available (to quickly pick up good or recovering companies) or for the average of the 3 previous years (in case macro economic conditions happened to be bad in the last year). This gives hope that the company’s management are fulfilling their basic task of generating a reasonable return from the money invested in the company. We see these metrics as complementary, as they have a common denominator (the 2 year average of Capital Employed, less intangibles), but the numerator for ROCE is earnings before interest and tax (EBIT), while CROCI uses free cash-flow.

- Reasonable or No Debt: we avoid excessively indebted companies that may collapse by picking those with no debt, or whose gearing (the ratio of debt to shareholder equity) is less than 80%, provided their earnings before tax is at least twice their net interest payments (i.e. their interest cover is greater than 2)

These selections are applied automatically by RuleTrader™, each month, to give us a list of shares that the strategy may wish to trade. Whether it does is determined by terms in the strategy that identify the best opportunities in the trading list. The strategy’s trading rules then use these terms to determine the best time to buy and sell these opportunities. In RuleTrader™ a term is the name for any expression that produces a number, a percentage, a share, a list of shares, or the result of some tested criteria (in the sense that the criteria has been met, or has not been met). We’ll see how they are used now.

Screening the trading list for opportunities

The trading list is filtered for opportunities using a share-list term called ‘Growth Opportunities’ (any name can be used for terms, trading rules and trading list selectors; we like to pick a name that describes what the item does). This term automatically sub-selects each day from the trading list all those companies that have:

- a ROCE or CROCI greater than 10% (this duplicate of the trading list criteria is included in case these results change during the month since the last trading list was selected)

- a long term price trend that is growing at 10% or more per year. For this we use RuleTrader’s™ unique AutoTrend™ feature, which automatically tracks micro, short, medium and long term price trends for us, which may develop over days, weeks, months or years, respectively

- an EBIT Yield of 10% or more

Each of the shares in the ‘Growth Opportunities’ list is then scored according to 5 factors, which are:

- Turnover Growth: measures how fast the cash flowing into the company is growing

- Gross Margin: tells us how much of that turnover is converted into gross profit. Furthermore, it gives an indication of the company’s ‘competitive moat’. A wide moat means it is able command a high price and thus a high gross margin. For a company to be able to do that it must be inherently differentiated from other companies, which bodes well for the future.

- Operating Cash Conversion: Indicates how much of the profit is converted to cash, which can be invested in the company, helping it to grow further, or returned to shareholders as dividends. EBITDA was chosen because it removes the effect of each company’s different financing and tax structures, which might otherwise distort the comparison between companies.

- EBITDA Yield: The focus of the first three factors – how income is turned into cash – provides a simple picture of how well the companies are run but it doesn’t give the whole picture. We also need an indication of how cheap the shares are relative to the returns we can expect. The normalised EBITDA Yield score gives us that.

- Price Growth: There’s a whole army of analysts and investors studying these companies in great detail, so why not ride on their backs? If they think the company is a good buy, then the price will be trending up. It’s not a fool proof reason to buy, but if the trend is consistent and established over a reasonable period, then it can be a good indicator – along with the other factors – that the company is going places. Again RuleTrader’s™ proprietary AutoTrend™ feature allows us to determine this automatically.

Scores are calculated simply by sorting each of the shares in the ‘Growth Opportunities’ list in descending order of each of these factors to produce 5 ordered lists (one per factor), with the best shares at the top. The index position of each share in a factor’s list then gives each shares’ score for the factor. So the best share is #1 in the list and has a score of 1, the second best share is #2 and so has a score or 2 and so on. These scores are added together to produce the final score for each share, with the shares that have the lowest total score being the best. Readers of the famous investor Joel Greenblatt’s books will recognise this approach as the method he uses – we just do it for more factors.

The top shares with the best scores are then automatically transferred to another share-list term called the ‘Value & Growth Buy List’. Enough shares are transferred to satisfy the number of positions the system is trying to fill to meet the trade-sizing criteria you set. For example, if you are targeting a trade size of 4% of capital, the total number of positions required would be 100/4 = 25 and so the number of shares transferred to the ‘Value & Growth Buy List’ would be 25 minus the number of already opened positions. If you’d like to know more about RuleTrader’s smart trade-sizing capabilities, please read our article on the subject.

Deciding When To Buy

The shares in the ‘Value & Growth Buy List’ are monitored by the strategy’s trading rules to determine the best time to enter a position in those shares. Again this process occurs entirely automatically, with the lists being updated each time a new item of relevant data arrives in ShareScope. When the optimum time is reached, a Buy or Sell signal is displayed against the share’s name in ShareScope’s Share List window, so you’ll know it’s time to trade (in back-tests, the signal triggers the execution of the trade, so the test gives the same results as if you had made the trade, on that day).

A great time to open a position is when the price of the share has hit a local low and just started rising again. Using AutoTrend’s™ named banding (see below) and lowest/highest price-tracking features, this is easy to do. So the trading rule is configured to wait until the lowest low price has reached the long price-channel’s ‘Lower Turn Band (outer)’, which is the very lowest band in the diagram, and then to wait until the short trend has turned upwards, indicating the price is now rising up from the low side of the channel. When this happens the trading rule is triggered and the buy signal is raised.

So instead of you spending your time wading through price charts, RuleTrader does it for you. All you need do is spend a few seconds each day to quickly check the signals displayed in the Share List window. You’ll find it saves an enormous amount of time, effort and stress.

Deciding When To Sell

The Value & Growth strategy uses two sales rules, which are applied to any share in the strategy’s trading list that has an open position. Again this all happens automatically with the rules being repeatedly evaluated every time new data is received.

The first rule looks for shares that no longer meet the criteria used to select shares for the strategy’s trading list or for the ‘Growth Opportunities’ list, as described earlier. Specifically, it looks for shares that meet any of these criteria:

- Too Small: Market cap now less than £20M

- Too Much Uncovered Debt: Gearing above 20% and interest cover less than 2

- Inadequate Return: Both ROCE and CROCI now less than 10%

If a share with an open position meets these criteria and its short term trend is not rising (i.e. the price isn’t going up) then the rule is triggered and a ‘Take Profit’ Sell signal is raised.

The second sell rule is a stop loss that is triggered when the long term trend breaks downwards and the short term trend is also flat or falling. At that point a ‘Stop Loss’ signal is raised.

Keeping Your Portfolio Balanced

The final trading rule is a rebalancing rule that is shared between both strategies and is designed to prevent potential losses in a position having an oversized effect on your capital. The rule is triggered when the size of any one position exceeds 10% of total capital. When this happens the rule signals that the position should be reduced by an amount that brings it down to the nominal trade size (i.e. the target size of a position when it is first opened).

Momentum Strategy

The Momentum strategy targets larger companies that meet the gearing and liquidity tests that are used by the Value & Growth (V&G) strategy. It then looks for companies whose longer term price trend is showing strong momentum, in the hope that trend will continue into the future.

The Momentum Trading List

As well as the liquidity and debt criteria applied by the V&G strategy (see earlier), the Momentum strategy picks companies for its trading list that have:

- Market cap greater than £100M and an average spread of 2% or less

- A 60 day price trend that is growing at an annualised rate of 20% or more

The Momentum Buy List and Buy Rules

Similar to the V&G strategy, the Momentum strategy uses a share-list term called ‘Momentum Opportunities’ that selects all those securities in the trading list, whose long term price trend is growing at a rate greater than 20% per year. These shares are then arranged in descending order of their long term trend’s growth-rate and the fastest growing shares are transferred to another share-list term called the ‘Momentum Buy List’. As with the V&G strategy, enough of these shares are transferred to meet the number of positions that still need to be found.

The strategy uses a single buy rule that raises a Buy signal when a share in the ‘Momentum Buy List’ meets these criteria:

- Its typical price (the high/low/close average) is more than 5% above its 250 day simple moving average. Often a share’s price will hover around the average, so by requiring +5% we ensure the price has moved decisively above the average

- The 250 day simple moving average has moved up over the last 5 days, so it is on an upward trend

- Its price has hit the low side of the long price-channel and is now moving up. This is detected using AutoTrend™ in the same way as for the V&G strategy i.e. it waits until the lowest low price has hit the long price-channel’s lowest band and the short term trend is moving up

The Momentum Sell Rules

The sale of a position is indicated when the long term price trend of the share has dropped below 20% per annum and another opportunity is available that meets the criteria, above, for a purchase. When this happens, one of three possible sell rules may be triggered.

The ‘Sell Momentum High’ trading rule attempts to maximise the return from the position by waiting until the share’s price has peaked in the upper outer part of the long term price-channel and has started to fall back. However, as this may never happen, we also have the ‘Sell Momentum Now’ rule, which takes over and closes the position if a sale hasn’t been made within 40 trading days.

The final sell rule is ‘Stop Momentum Loss’, which closes the position in a share, when that share’s price has moved more than 5% below its 250 day simple moving average.

The Real Secret Of The System

With only 8 trading rules the Example Trading System isn’t terribly complicated or clever. So why does it work so well? We believe its down to five key characteristics of the system, which are intrinsic to the RuleTrader approach to investing:

- Powerful: As we’ve seen, the Example system contains two strategies. The Value & Growth strategy picks excellent companies using a five-factor score, which is designed to pick the diamonds from the dogs. Applying such a sophisticated filter manually would be very arduous but with RuleTrader it’s automatic. Similarly, the Momentum strategy uses RuleTrader’s unique AutoTrend function to jump on trends at a local low and to exit at a high, or when the trend breaks

- Cuts losses early and lets profits run: You’ll see in the performance figures that slightly less than half of the Example system’s positions are profitable, so it’s not prescient; if it were, we’d suspect it was over-optimised. What’s important is that the profits it does make are over twice as large as its losses. Part of the reason for this it that it holds winning positions for over two and a half times longer (> 10 months), on average, than losing positions (<= 4 months).

- Combines fundamentals with technical indicators: Both strategies select potential opportunities based on fundamentals, then uses RuleTrader’s technical indicators, such as its AutoTrend™ price-channels, to determine the optimum time to enter and exit positions. This ability to combine fundamental and technical approaches is one of RuleTrader’s most useful features.

- Acts quickly: The back-test assumes orders are placed at close on the day a signal is raised (you can also simulate trading the next day, based on information from the evening before, if that’s a better fit with your investment style). To replicate these results in a live system, you’d need to review your trading signals daily. Normally, that would be hard work, but with RuleTrader it takes just seconds, so it’s very easy to do, which means you can now exploit your key advantage over the big institutions – your speed – with practically zero effort.

- Dispassionate: RuleTrader doesn’t do angst – it just consistently applies the rules you devise. Emotions don’t cloud its judgement; recent wins don’t make it reckless; and losses don’t make it too cautious. The key is to use its tools to build a mechanical system that doesn’t care about wins and losses, only profit ratios. Then tailor it to your needs, back-test it to build your confidence and then, when you’re satisfied with its performance, deploy it for live trading with RuleTrader Live and let your computer do all the hard work. So now you can kick back, relax and let your profits run

Example System Implementation

To see how the system was implemented, and to learn techniques you’ll find useful in your own automated investment system, please follow the links below, or use the navigation panel on the left, to find out more:

- The System’s Trading Universe: See how this is defined using the Trading Universe tab on the Trading Specification Dialog

- Value & Growth (V&G) strategy:

- Strategy Trading List Selection: Learn how List Selectors are layered to provide efficient, transparent list selection

- How The Strategy Screens For Opportunities: Understand how share-list Terms can be constructed to zero in on the best opportunities

- Strategy Trading Rules: Explore how conditional terms are created to define when Trading Rules are triggered

- Momentum strategy:

- Strategy Trading List Selection: See how the lists can be selected based on statistics, such as price trends

- How The Strategy Buys Shares: Learn how you can create further statistics, such as averages, and use them in value expressions

- How The Strategy Sells Shares: Understand how Persistent Terms can be used as counters

- The System’s Shared Terms: Don’t duplicate work, when you can share terms between strategies